Faq: answers to the most common questions on customs issues

- P2 Certificates (Certificate for the export of pasta to the U.S.A)

- Export

- Temporary export

- Allowances

- ICS - AIS (Import Control System - Automated Import System)

- Import

- Binding Tariff Information (B.T.I,)

- Intr@web

- FAQ Intrastat

- Inward processing

- Outward processing

- Export refunds (S.A.I.S.A. Autonomous Agricultural Intervention)

- Customs telematic service (EDI) preparation of documents for electronic submission

- Customs telematic service (EDI) how to use service

- Electronic data transmission of excise duties – AAD telematic

- Electronic data transmission of excise duties – Energy products sector

- Electronic data transmission of excise duties – Alcohol sector

- Transit – authorised recipients

- Currency

- Vehicles

- Web Service

Export

Question – Compliance for export of goods:

I have to export goods to a non-EU country? What documentation do I have to produce?

Answer: The current Customs Union legislation does not provide for duties or customs duties in export to third countries. Clearly, destination countries will apply their own regulations at the moment of importation.

So far as customs export formalities are concerned, it should be noted that it is necessary to associate the goods which are to leave EU territory to the specific regime by way of a customs export declaation. The method of compilation is contained in the circular 45/D of 11/12/2006 (which can be consulted on the Agency’s website - www.adm.gov.it - at “General Administrative Acts – Circulars – Year”), accompanied by commercial documents and any licences, authorisations or permits should these be mandatorily requested for the export of the particular type of goods in question.

That said, it should be noted that, from 1 July 2007, in cases which envisaged by EU law, the Union Export Control System (ECS) will apply. Said system provides that the operator presents a customs declaration to the customs export office, which, once this is received and has authorised the release of the goods, will issue the declarant with an AAD (Accompanying Administrative Document), which document will remain with the goods up until the customs office of exit.

The second phase of ECS began on 1 July 2009, rendering the transmission of the customs declaration in an electronic format mandatory, in addition to the obligation of indicating the data requested regarding safety.

For any operational information, please enquire at your local customs office.

Question – Requirements for the issue of the exit visa for exports effected with E.C.S.:

Following upon the application of the Community Automated Export Control System (A.E.S.), I would like some clarification on the issuing of the exit visa.

Answer: For A.E.S. operations, the visa sticker affixed to the exit visa on copy 3 of the DAU is substituted with the electronic messaged “exit results”, sent by the exit customs to the export customs.

The information in the possession of the customs Administration is equivalent to the proof of exit from the European Union and is present in the IT system of the Customs Agency (A.I.D.A.) which can be consulted by economic operators by keying in the MRN (Movement Reference Number) of the website of this Agency www.adm.gov.it => CUSTOMS => ECONOMIC OPERATOR => AIDA PROJECTS => DIGITISATION OF CLEARANC PROCESS =>AES (export automation) => M.R.N. EXPORT NOTIFICATION (Movement Reference Number)".

On the website of the European Community it is possible to check the Community MRN, that is, the Movement Reference Number for which the exit customs and the export customs belong to two different Member States; the link of the Commission may be reached through our website => CUSTOMS => ECONOMIC OPERATOR => AIDA PROJECTS => DIGITISATION OF CLEARANC PROCESS => AES (export automation) => ELECTRONIC TRACKING OF EXPORT OPERATIONSAMONG INTRA-COMMUNITY COUNTRIES.

In taxation terms, the operation constitutes “an export sale” and is not subject to VAT (article 8 of Presidential Decree no. 633/72).

For any operational information, please contact your local customs office.

Question – Duplicate request for customs export declaration:

Our freight-forwarder has sent the original export customs bill by priority post but we have never received it. In order to have the duplicate, what do we have to do?

Answer: For export operations carried out prior to 1 July 2007, in addition to operations carried out subsequently to that date but which are excluded from application of the new Community Automated Export Control System (ECS phase 1), it should be noted that a request for the duplicate document no. 3 of the export customs declaration must be effected at the export customs office, that is, the customs office of departure (which may coincide with that of exit).

For further information, please consult Circulars no. 75/D of 11/12/02 and no. 10/D of 01/03/2004, published on the Agency’s website, www.adm.gov.it, at the "General Administrative Acts – Circulars – Year" .

From 1 July 2009 all export operations are being managed electronically, therefore the paper-based version declaration no. 3 no longer exists.

Question – Shipment of gift packages:

I have to send some goods, as gifts which are not to be sold, to some relations who are resident in a country which does not form part of the EU. What duties do I have to pay? Do I have to pay VAT or an equivalent tax?

Answer: In customs terms, the union legislation currently in force does not envisage the payment taxes or customs duties for exportation to third countries. Clearly, the country of destination will apply its regulations in this regard at the moment of importation.

Where internation couriers or postal services are used for these shipments, it will be necessary to fill in the relative accompanying documents for the shipment.

Temporary Export

Question – Temporary export for exhibition/sale of goods at a fair:

To send goods for the purposes of a fair to a non-EU country, what are the customs procedures to be followed and what documents do we have to produce? Additionally, if the said goods were to be sold, what do we have to do?

Answer: The goods in question can be temporarily exported and subsequently reimported without payment of the relative customs duties pursuant to art. 214 of the Presidential Decree no. 43 of 23 January 1973 (Customs Consolidation Act). In this regard, please note that the maximum period abroad for said goods is five years (Circular no. 7/148/IX of 21?01/1982).

Where the country of destination has adhered to the ATA Convention, similarly, it is possible to apply to the institute for temporary export with the issue of an ATA carnet (passport for goods) which accompanies the goods (issued by the Association authorised for Italy by the Italian Union of Chambers of Comerce). The function of this carnet, which must clearly identify the goods, is not only that of simplifying the customs procedures of the various countries involved, but also that of verifying the re-entry of the goods. In this regard, please not that the period allowed for the reimportation of the goods may not exceed that of the validity of the carnet itself.

In both cases of temporary export, where goods are sold overseas, it is necessary that the operation is regularised for customs purposes with the presentation of a customs declaration of final export.

To all intents and purposes, given that the operation is purely operational, it is suggested that users contact the territorially-competent customs office. In this regard, please note that the address and the relative telephone contacts are available on the “homepage” of the Agency website, www.adm.gov.it – About us => Organisation chart => Addresses and e Organisation chart – Customs area => Customs offices.

Allowances

Question – Maximum cigarette allowance for travellers:

I am an Italian citizen and I travel frequently abroad for work. I would like to ask the following question: what is the maximum limit, in terms of number of pieces, of cigarettes which I can import into Italy from abroad for exclusively-personal use? Does this limit change according to whether trips are between EU countries or with non-EU countries?

Answer: A traveller arriving in Italy from a non-EU country, can bring with him, duty-free cigarettes up to a maximum of 200 cigarettes (one carton); while, a traveller arriving from an EU country can bring with him a maximum of 800 cigarettes (4 cartons) but for travellers coming from Bulgaria, Croatia, Latvia, Lithuania, Romania, Hungary, the limit is reduced to 300 cigarettes.

Question – Import of inherited goods:

After the death of a relative, I would like to take goods into a non-EU country. Can you tell me how to proceed?

Answer: As regards personal property which has been acquired by way of testate or intestate succession from a physical person resident within the customs area of the European Union, there is an exemption from customs duties (articles 17 to 20 of the EU Regulation no. 1186/2009).

In this regard, please note that:

- Goods indicated in article 18 of the said Regulation (for example, alcohol, tobacco and tobacco products, commercial means of transport etc) shall remain subject to duties;

- The importation subject to this exemption can be effected within two years of taking possession of the goods. However, an extension to said term may be granted by the competent authorities where there are special circumstances.

To obtain this exemption, the interested party should present a document issued by a notary or other competent authority in the third country, which certifies that the imported goods have been acquired by way of inheritance.

The authorization of the exemption is issued, on request by the interested party, directly by the local customs office at the point of arrival of the goods. For further information please consult Circulars no. 2/D of 03/02/2010 and no.22/D of 05/05/2004 – consultable on the Agency website, www.adm.gov.it, in the section "General Administrative Acts - Circulars - Years 2010 and 2004".

Question – Transfer of moveable property from a non-EU country:

I require to transfer some of my moveable property from a non-EU country. What are the customs formalities required in such cases?

Answer: For personal goods imported by physical persons who transfer their usual residence from a non -EU country to an EU country, the importation subject to customs duties exemption is permitted (articles 3 to 10 of the EU Regulation no. 1186/2009 and article 3 of the Ministerial Decree no. 489 of 1997) provided that:

- the interested party transfers his/her usual residence to EU territory after having been resident outside the EU for a period of 12 consecutive months;

- the personal goods imported have been used for a period of at least six months in the prior place of residence.

The authorization of the exemption is issued, on request by the interested party, directly by the local customs office at the point of arrival of the goods.

For further information please consult Circulars no. 2/D of 03/02/2010 and no.22/D of 05/05/2004 – consultable on the Agency website, www.adm.gov.it, in the section "General Administrative Acts - Circulars - Years 2010 and 2004".

Question – Gift from a non-EU Country:

A private individual sent me a gift from a non-EU country, and I was surprised at having to pay customs duties even although “GIFT” was written on the shipping bill. I would like to know how customs duties are calculated in this case.

Answer: From a customs standpoint, the current legislation provides for an exception when:

- the shipment is made between private individuals

- is not for financial gain

- is free of charge

- the value does not exceed 45 Euro per shipment

(Regulation (EU) no. 1186/2009, Ministerial Decree 5 December 1997, no. 489 articles 7 to 9). For further information it is possible to consult Circulars no. 2/D of 03/02/2010 and no. 22/D of 05/05/2004 – available on the Agency website, www.adm.gov.it, in the “General Administrative Acts . Circulars – Years 2010 and 2004”.

Where the shipment does not fall within this ambit, generally speaking, when goods originating from outside the EU are brought into Italy, it is necessary to pay:

- customs duties (where applicable), which are calculated on the “transaction value” (the total value inclusive of transport and insurance costs) the tax rates of which vary according to the goods to be imported;

- of VAT (applied according to current tax rates) calculated on the “transaction value”, plus any tariff rate due.

It is important to determine the product type (the customs classification of goods) and also product segment, both as regards the application of the correct duties and taxation regime, and for any requirements of licenses or the existence of any import restrictions.

Useful information in this regard can be found on the Agency website, www.adm.gov.it, on the “Customs Duties TARIC”.

Please note that the definitive classification of the goods will be determined by customs officials only upon presentation of the goods in customs.

Question – Purchase online of low-value goods:

Sometimes I buy low-value goods online and sometimes I am surprised at having to pay customs costs. I would like to know how these costs are calculated?

Answer: From a customs standpoint, current EU legislation (article 23 of Regulation (EC) 1186/2009) enables an exemption to import duties to be applied to shipments of goods which have a negligible value shipped to a subject resident in a non-EU country and to a person who is in the Community, provided that the value of said shipment does not exceed the intrinsic value of €150.

By intrinsic value is meant the value of the goods excluding transport and any insurance costs.

Alcohol products, perfumes and eau de toilettes, tobacco and tobacco products are excluded from the exemption from duties.

From a taxation point of view, the exemption for VAT purposes is fixed on an intrinsic value of €22 (article 5 Ministerial Decree no. 489/97); for example, for the purchase of goods having a value of between €22 and €150, an exemption from customs duties will be applied, but the relevant VAT rate will be applied. It is worthwhile mentioning that if the value of the goods exceeds the exemption limits, the importer must pay the customs duty on the whole value of the goods purchased.

Therefore, where the foregoing conditions are not met, the importer must pay the duties when the goods are brought into Italy from a non-EU country:

- customs duties (where applicable), which are calculated on the “transaction value” (the total value inclusive of transport and insurance costs) the tax rates of which vary according to the goods to be imported;

- of VAT (applied according to current tax rates) calculated on the “transaction value”, plus any tariff rate due.

It is important to determine the product type (the customs classification of goods) and also product segment, both as regards the application of the correct duties and taxation regime, and for any requirements of licenses or the existence of any import restrictions which however are not applied where the goods qualify for the exemption.

Useful information in this regard can be found on the Agency website, www.adm.gov.it, on the “Customs Duties TARIC”.

Please note that the definitive classification of the goods will be determined by customs officers only upon presentation of the goods in customs.

Question – Travellers with accompanying personal goods:

I would like to know what the value of goods imported free of duty is for a traveller entering Italy from a non-EU country.

Answer: The current EU legislation and the relative national regulation provides for the exemption from customs duties, from VAT and from excise duties for goods which travellers, coming from third countries, carry with them in their personal luggage, on condition that the importation is not commercial and that the overall value of the goods does not exceed €300 per traveller. (article 41 del Regulation (EC) 1186/2009, VAT Directive no. 74/2007 of the Council, Decree 6 March 2009 no. 32 and Circulars no. 2/D of 03/02/2010, no. 14/D of 11/06/2009 and no.43/D of 28/11/2008 – available on the Agency website, www.adm.gov.it, at “General Administrative Acts – Circulars - Years 2010, 2009 and 2008"). The threshold will be increased to €430 in the case of those travelling by air or sea (for air and sea passengers are intended those who travel by air or sea, with the exception of private recreational air and sea travel).

For travellers under 15 years of age, the above thresholds have been reduced to €150 per traveller, regardless of the means of transport used.

For the purposes of calculation of the above thresholds, please note that the value of each good cannot be split.

Tobacco products, alcohol products and alcoholic beverages, there are quantitative limits which can be found on the Agency website at Customs => The Citizen => Travellers’ Customs Charter.

Please note that where the value of the goods exceeds the limits of the exemption, the traveller must pay the customs duties on their whole value.

Importation

Question – Calculation of customs duties on goods to be imported:

I would like to know how to calculate the customs duties on the import of goods bought outside the EU and imported to Italy.

Answer: The taxable amount on which to apply the ad valorem duties (most customs duties fall into this category) comprises the transaction value, that is the price actually paid or to be paid for the goods (normally the price written on the invoice), inclusive of freight and insurance costs.

However, the taxable base on which VAT is calculated on importation is made up of the customs value described above, to which is added any additional duties and forwarding costs to the final destination within EU territory (article 69 Presidential Decree no. 633/72).

It is however important to define precisely the type of goods (customs classification of the goods) also from point of view of the product segment for the application of the correct tax and duties regime, in order to ascertain the necessity of any licences or the existence of any restrictions on the importation.

Useful information on the subject can be found consulting the Agency website, www.adm.gov.it , at the “The Customs Tariff (TARIC)”.

It should be noted however that the definitive classification of the goods will be determined by customs officials only upon their presentation in customs.

Question - Customs duties on musical instruments purchased outside the EU:

Given that I require to purchase a musical instrument which comes from a non-EU country, I would like to know what customs expenses I will incur.

Answer: In general, at the moment the non-EU goods are brought into Italy, the importer must pay:

- customs duties (where applicable), which are calculated on the “transaction value” (the total value inclusive of transport and insurance costs) the tax rates of which vary according to the goods to be imported;

- of VAT (applied according to current tax rates) calculated on the “transaction value”, plus any tariff rate due.

It is however important to define precisely the type of goods (customs classification of the goods) also from point of view of the product segment for the application of the correct tax and duties regime, in order to ascertain the necessity of any licences or the existence of any restrictions on the importation.

Useful information on the subject can be found consulting the Agency website, www.adm.gov.it, at the “The Customs Tariff” (TARIC)” – section XVIII – chapter 92, musical instruments.

Question – Customs duties on IT equipment purchased outside the EU:

Given that I require to purchase IT materials such as: computer, Notebook (portable PC), printer for PC etc which comes from a non-EU country, I would like to know what customs expenses I will incur.

Answer: In general, at the moment the non-EU goods are brought into Italy, the importer must pay:

- customs duties (where applicable), which are calculated on the “transaction value” (the total value inclusive of transport and insurance costs) the tax rates of which vary according to the goods to be imported;

- of VAT (applied according to current tax rates) calculated on the “transaction value”, plus any tariff rate due.

It is however important to define precisely the type of goods (customs classification of the goods) also from point of view of the product segment for the application of the correct tax and duties regime, in order to ascertain the necessity of any licences or the existence of any restrictions on the importation.

Useful information on the subject can be found consulting the Agency website, www.adm.gov.it , , at the “The Customs Tariff” (TARIC)” – section XVI - chapter 84, customs item 8471.

Question – Flat-rate customs duty for non-EU goods:

I have heard that a flat-rate customs duty is applied to goods coming from countries which do not form part of the EU and which are intended for an Italian citizen. Can you give me some more information?

Answer: The “Integrated Tariff of the European Union” TARIC provides for the application of a flat-rate (2.5%) ad valorem on goods contained in shipments between private individuals, or contained in the personal luggage of travellers, on condition that these are non-commercial imports and which have the following characteristics:

- they are of an occasional nature;

- the goods are intended for personal or family use;

- they are dispatched by the send to the recipient without any form of payment.

Where the intrinsic value of the goods, in respect of which import duties are payable, does not exceed €700 per shipment or per traveller, it is possible to apply a flat-rate customs duty of 2.5%.

Please note that the flat-rate customs duty cannot be applied to “Tobacco and manufactured tobacco products”, sent separately or which are contained in the traveller’s personal luggage, and which exceed the limits fixed respectively in article 27 or in article 41 of Regulation (EEC) 1186/2009.

Inward processing

Question – Temporary importation for re-exportation after manufacture:

A client of mine, who has a head office in a non-EU country has to send me some raw materials, which will be shipped back back to him after processing.

The raw materials therefore are not sold, but only delivered for the purposes of processing.

After processing, we will ship the finished articles invoicing our customer exclusively for the processing. How should we proceed in order to avoid payment on delivery of the onerous customs duties?

Answer: In the situation described, it is possible to request provisional authorisation from the competent customs office for the location where the processing is due to take place, application of the “inward processing” customs regime. This regime makes it possible to import goods on a temporary basis for the purposes of processing (or repair) and re-exporting the finished products outside the territory of the EU without paying customs duties on the raw materials temporarily imported.The only performance required is the payment of a guarantee which is equal to the amount of the import customs duty which would have been due on the import of the raw materials. This guarantee is repaid on re-export of the so-called “compensating” products.

The inward processing regime is governed by articles 255/258 of Regulation (EU) 952/2013 and of articles 240-241 of Regulation (EU) 2446/2015 and of the Circular no. 8/D of 19/04/2016 (available on the Agency website, www.adm.gov.it, in the section “General administrative acts – Circulars – Year 2016”).

To obtain any other information on the above, please contact the territorially competent customs office.

Outward processing

Question – Temporary export for maintenance/repair:

I have to send, for the purposes of assistance/repair an electronic device to the country of manufacture, which is outside the EU. I have been told that on its re-entry to Italy I will require to pay customs dutys (which I have already paid at the moment of purchase. Is this true?

Answer: The export of goods for repair/processing comes under the customs regime definition of “outward processing”. This regime makes it possible to temporarily export union goods outside the EU customs territory for the purposes of “processing” (manufacture, repair, assembly etc) and to reimport the finished products, with a complete or partial exemption from import duties.

The goods will not be subject to any duties at time of reimportation only in the case where the repair (or processing) has been done free of charge. On the other hand, where a charge is envisaged for the processing, the duties and VAT will be calculated on this figure (the rate will be that of processed products).

The outward processing regime is governed by articles 259 et seq of Regulation (EU) 952/2013 abd of articles 242 and 243 of Regualtion (EU) 2446/2015.

“Outward processing” is granted by the customs office with competency for the area where the head office of the company making the request is located.

Question – Non-commercial outward processing:

I have sent goods for repairs which are free of charge to a company which does not form part of the EU. Once repaired, the goods were returned to me but I had to pay the customs duties. I would like to emphasise that at the moment of purchase, a year ago customs duties and IVA were paid on the same goods. Can I request a refund and, if so, from what office?

Answer: The temporary export outside the customs territory of the Community of community property to be repaired free of charge or for other non-commercial operations, and the subsequent reimportation of the same goods with total (or partial) exemption from customs duties, falls under the so-called “outward processing” regime, provided for in the EU legislation (article 163, paragraph 1e) of Regulation 2446/2015. The authorisation may be requested on importation of the products, so long as the goods are non-commercial

Transit – Authorised recipients

Question – When to use the Customs Desktop plugin issued by the Customs and Monopolies Agency? (NCTS – Authorised Recipients)

Answer: The plugin issued by the ADM is intended for users who wish to interact with the customs system rapidly, without having to integrate in their own IT systems the requests to the remote service and the feedback. The information which is exchanged through web services is the same whether the client RCP released by ADM or the system owner.

Question – Does the plugin issued by the Customs and Monopolies Agency have to be updated? (NCTS – Authorised Recipients)

Answer: The plugin issued by ADM for Authorised Recipients is self-updating, every time it is switched on this contacts the server silently and, in case of updates, downloads and installs the new element of the product.

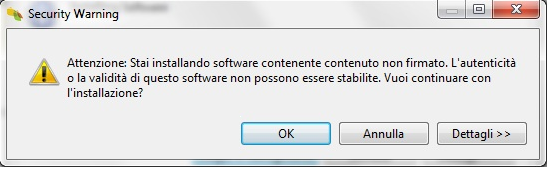

Question – When I install the Authorised Recipients’ plugin I get the following alert. What should I reply? (NCTS – Authorised Recipients)

Answer: It is necessary to press “ok” to continue with the installation. Plugins issued by ADM are authorised and are considered safe software. However where use has been made of third party, open-source software, it is possible that you receive this alert in that signing such software libraries would constitute a violation of rights. In any case the repository from which the plugin is downloaded is safe and therefore all the software published may be considered unmalicious.

Question – What do electronic messages which are published in the authorised recipients’ section consist of? (NCTS – Authorised Recipients)

Answer: The electronic messages make it possible to use the research services made available to the authorised recipient (hereafter user). In fact the customs system expects to receive from the user a IE007 (notice of arrival) message and during the electronic dialogue it will expect one or more messages IE044 (download alerts). On receipt of these messages, the customs system will generate a protocol number. This message ID may be employed by the user to obtain the answer from the customs system by the “Search by protocol” service. A search by movement ID can be done by filling in the MRN fields of the enquiry.xsd path, while filling in the other search fields will generate other results.

Question – Where can I find the documentation for errors due to the violation of EU rules and conditions? (NCTS – Authorised Recipients)

Answer: All the documentation relative to the Authorised Recipients is published in the “Home – Customs – Economic Operator – Online Services – Electronic Customs Service – E.D.I. – Web Service – Real/Test Environment – Authorised Recipients” on the Customs and Monopolies Agency website.

Question – What are the messages which I can expect to receive in response to my enquiries? (NCTS – Authorised Recipients)

Answer: After sending the electronic arrival notification message (IE007) and any changes of state of the movement on the list of client’s movements, the backend system can produce:

- IE008 (Arrival notification rejection) the reason for the rejection is contained inside;

- IE021 (Transit notification rejection);

- IE043 (Unloading permission) the transit declaration data is contained inside.

After sending the message unloading remarks (IE044) and any changes of state of the movement on the list of movements of the client, the backend may produce:

- IE058 (Unloading remarks rejection) the reason for the refusal is contained inside;

- IE025 (Goods release notification);

- IE043 (Subsequent unloading permission) only the progressive unloading permission number is contained inside.

Question – When can I expect to receive an IE100 (Document presentation request)? (NCTS – Authorised Recipients)

Answer: From the moment that the backend receives the notification of arrival on the part of the authorised recipient, the customs officer may issue at his discretion the request to present documents in customs, up until the moment when the movement has completed its life-cycle.

Question – Can the messages envisaged by the interview protocol between the recipient office and the authorised recipient be sent and received by a subject other than the authorised recipient? (NCTS – Authorised Recipients)

Answer: Yes, they can be sent and receive by a service provider on condition that the messages have been signed by the applicant (authorised recipient) or by his unitholder. As regards the user profiles concerned (service provider, applicant and unitholder) please refer to the “FAQ relative to ADHESION and ENABLING for the Electronic Customs Service” – “ADHESION to the ELECTRONIC SERVICE: ‘Electronic user: user profiles'”.

Currency

Question – Personal currency:

How much cash can be carried in personal luggage when travelling to and from abroad, and what are the sanctions in case of violation?

Answer: The transport of personal cash or equivalent items is permitted for overall amounts of less than 10,000 euro. In excess of this limit, it is necessary to complete a declaration, to be signed and lodged exclusively at the customs office when entering or leaving Italy. The declaration form is available on the Customs and Monopolies Agency website www.adm.gov.it – Customs – the Citizen – Other information for the traveller and/or forms/documents. The measure applies to all movements from and to EU and non-EU countries.

Failure to declare constitutes an infringement of the currency law and gives rise to:

- The administrative seizure up to 40% of the amount exceeding the limit fixed;

- The application of an administrative sanction, of up to 40% of the amount exceeding the fixed limit, with a minimum sanction of €300;

- Sums seized in excess of the limits set by the Ministry of Economy and Finance, will be repaid to entitled persons where they have submitted a request to this effect within five years of the date of the seizure.

In cases envisaged by law (infringements non in excess of €250,000 and in the absence of a similar benefit having been used in the preceding 365 days) the transgressor can request that the violation be declassified, on the immediate payment of a reduced fine equal to 5% of the sum exceeding the limit, subject to a minimum payment of €200. This payment is to be made directly at the customs offices. The payment may be made within 10 days of the violation in favor of the Ministry of Economy and Finance. Where simultaneous payment is made, seizure will not be made.

Vehicles

Question – Circulation in Italy with a vehicle, with non-EU number plate:

I would like to know if it is possible for a non-EU registered vehicle to circulate in Italy. Can you tell me what the regulations are in this regard?

Answer: This concerns the temporary admission regime applied to vehicles matriculated in a third country and drive occasionally by a subject established in the EU. In the application of article 215 paragraph 1 of Regulation (EU) no. 2446/2015 it is possible that a subject who is established in the EU uses privately and occasionally a vehicle which has been registered in a third country and which is the property of a third party, as long as the latter is on the EU territory at the moment of use of the vehicle and that he has authorised such use. In this case, it would be opportune that the authorisation on the part of the owner of the vehicle for use on the part of the EU subject is, in addition to being carried by the driver, is also presented at the customs which are competent in the place of use, in order to allow verification of the conditions envisaged by the above norm for the use of the third party goods. For further information please contact the Italian customs office on entry to the EU territory. The telephone contacts are available on the homepage of the Agency website, www.adm.gov.it – About us => Organisation Structure of the Offices => Branch Addresses and Organisational Chart – Customs Area => Customs Offices.